Degens and Degenettes,

Welcome to your weekly dose of The Radical Moderate - a smorgasbord of the ideas we’ve been discussing, the money moves we’re making, and fun things that are going on in the community. Share with a buddy if you want :)

Take Of The Week

Nick shared a story about an interview with Charlie Rose and Magnus Carlson about taking risk. Magnus Carlson is most likely the greatest chess player to ever exist, and his approach to risk is pretty interesting. Basically, he approaches risk through the lens of a rational optimist. He goes on to say that being an optimist and a risk taker is a necessity when playing Chess. Because if not, you start see threats that are not actually there. You have to be a risk-taker so that you’re in “opportunity-finding mode”, not operating out of fear.

Pessimists are right 99% of the time, but the money tends to flow to the optimists. If you’re over the age of 40, I’d start with the assumption that your opinions about new ideas and new tech are wrong. It’s in our nature to become more jaded with time, and you might miss out on life-changing opportunities by keeping your head in the sand. Not sure what the action-steps are for this philosophy, but there’s something there.

Shill Of The Week

Crypto

The question posed was “what coins are you most bullish on right now?”

Nick’s pick:

$SNX - Been around a long time and producing revenue. Perps, gambling, and seems to be a lot of activity around the platform

Stephen’s pick:

Well, he had a lot. So here’s the list:

$BLUR

$LIDO

$TIA

$IMX

$RNDR

$BEAM

$NEAR

TradFi

$HOOD - Eric and Stephen talked about Robinhood on the latest episode of Irresponsibly Long, and the stock has basically been in a two-year long consolidation range. If you missed Coinbase mooning, then Robinhood could be the move. Do we still have to say not financial advice? Well, not financial advice.

$PFE - This one has not been endorsed by everyone in the group, but this week’s pod was about embracing risk and volatility, so here’s my rational for Pfizer: $PFE is dropping below its 5 year low, and has been basically been a dumpster fire for the past 3 years. They're using a lot of debt and the social sentiment against big pharma has been atrocious. But, betting on them at $27 is a bet that there will be some shed of innovation over the next 10 years. They’re currently working on a drug that helps patients with Hemophilia and are looking like they’ll beat Novo Nordisk to the punch. I like this bet, but who knows… go make your own decision.

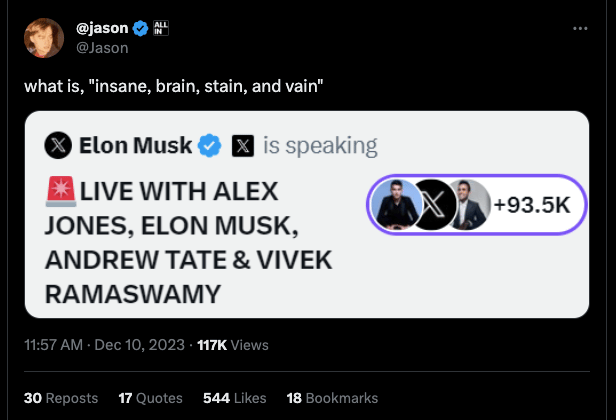

Tweet Of The Week

Is someone sad he wasn’t invited? @jason

Takeaways

We talked a lot about embracing risk on the latest episode. I’d imagine most of our audience deals with risk/loss better than the rest of society. You probably wouldn’t be interested in crypto if you weren’t a little bit of a masochist. Risk and volatility are interesting subjects because they’re affiliated with emotions you’ll never fully be able to ignore. We are generally loss-averse creatures. The pain of losing $1,000 is WAY greater than the joy of making $1,500. But, to quote Matt Damon in shittiest and cringiest crypto.com commercial of all time, “Fortune favors the brave.”

Deuces✌️📈

Alfalfa Intern